Mortgage success in Orlando requires a strategic approach to digital marketing. By leveraging various online tools and techniques, you can significantly increase your leads and connect with potential clients ready to secure their loans. This guide will provide you with simple, actionable steps to enhance your digital presence, engage your audience, and ultimately, transform your mortgage business. Dive in to discover how you can optimize your marketing strategies for maximum impact and profitability.

Key Takeaways:

- Utilize Social Media: Leverage platforms such as Facebook and Instagram to engage with potential clients and showcase your mortgage offerings through targeted ads.

- Implement SEO Strategies: Optimize your website and content for search engines to increase visibility and attract organic traffic from local Orlando searches.

- Create Valuable Content: Develop informative articles, guides, and videos that address common mortgage questions to establish credibility and attract leads interested in your services.

Understanding Digital Marketing

Before plunging into the strategies for maximizing your mortgage leads, it’s vital to understand digital marketing’s role in today’s industry landscape. With increasing consumer reliance on online platforms for information and services, developing a comprehensive digital marketing strategy will help you reach potential clients effectively. By leveraging various online channels, you can create connections, enhance your brand visibility, and ultimately drive higher lead conversion rates.

What is Digital Marketing?

Clearly, digital marketing encompasses all marketing efforts that use the internet or an electronic device. It includes a diverse range of tactics such as search engine optimization (SEO), social media marketing, email campaigns, and online advertising. By utilizing these methods, you can connect with your audience in real time and engage them through personalized content.

Importance of Digital Marketing in the Mortgage Industry

Marketing in the mortgage industry increasingly relies on digital marketing techniques to foster growth and customer connections. With potential borrowers searching for mortgage options online, having a solid digital presence is critical. This allows you to target your ideal audience effectively, showcase your services, and ultimately increase your mortgage leads.

What you might find compelling is that embracing digital marketing can help you stay ahead in a competitive market. The digital landscape allows for targeted advertising, re-engaging past clients, and attracting new ones, ensuring that your outreach is both effective and efficient. By implementing strategies such as SEO and social media marketing, you can increase your visibility, build trust, and encourage client inquiries, leading to a sustainable increase in your mortgage leads.

Identifying Target Audiences

Some key steps to identifying target audiences include understanding demographics, interests, and pain points. By honing in on the specific characteristics and preferences of potential mortgage customers in Orlando, you can tailor your marketing efforts to reach those most likely to convert, maximizing your lead generation efforts.

Defining Your Ideal Mortgage Leads

Your ideal mortgage leads are those who best fit your lending criteria and are most likely to benefit from your services. Creating a detailed profile based on factors such as income, credit score, and location will help you target your marketing strategies effectively, ensuring you reach the right potential homebuyers.

Utilizing Data for Audience Segmentation

Assuming you have access to valuable data sources, you can effectively segment your audience for improved targeting. With this information, you can refine your messaging and marketing channels to resonate more closely with your prospective clients’ needs and preferences.

Target segmentation involves analyzing demographic data from market research, customer surveys, and online behavior to create distinct profiles of your audience. By leveraging this information, you can develop highly targeted marketing campaigns that speak directly to the specific needs of each segment. This approach allows you to not only maximize your reach but also to enhance your conversion rates by addressing the most relevant pain points faced by potential leads. Notably, the more precisely you segment your audience, the more effective your digital marketing strategies will be in generating high-quality mortgage leads.

Essential Digital Marketing Strategies

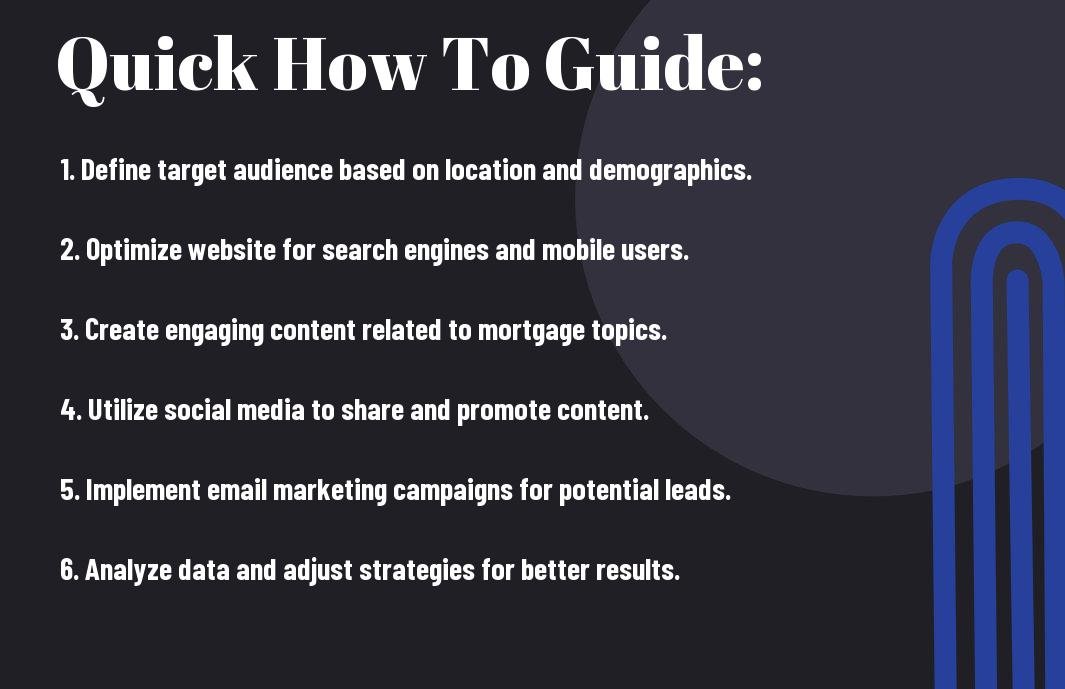

Unlike traditional marketing methods, leveraging digital marketing strategies can significantly enhance your mortgage leads in Orlando. To get started, consider exploring How to Create the Best Digital Marketing Plan for Mortgage …, ensuring that you have a comprehensive strategy tailored for your business.

Search Engine Optimization (SEO) Tips

If you want to improve your online visibility, focus on key keywords relevant to your mortgage services, such as mortgage rates and first-time homebuyers. Also, create quality content and optimize your website structure. Remember to:

- Research your target audience.

- Utilize local SEO techniques.

- Monitor your competitors.

Thou must continuously evaluate your SEO performance to stay competitive in the market.

Maximizing Social Media Engagement

Marketing through social media is crucial in reaching potential mortgage leads. Utilize platforms like Facebook and Instagram to connect with your audience, share valuable content, and respond to inquiries promptly. Regularly engaging with your followers builds trust and encourages potential clients to reach out.

Plus, using features like polls, stories, and live sessions helps to create a dynamic interaction with your audience. Sharing success stories and customer testimonials can also enhance your reputation. Be mindful of, the key is to be authentic and consistently provide valuable information to keep your followers interested and engaged.

Lead Generation Techniques

For mortgage professionals in Orlando, implementing effective lead generation techniques is crucial to elevating your business. From utilizing social media platforms to optimizing your website for search engine visibility, these strategies can help you attract high-quality leads. Make sure to focus on targeted campaigns that speak directly to your ideal customer, ensuring you maximize your outreach and conversion rates.

Effective Email Marketing Approaches

There’s no substitute for personalized communication in your email marketing efforts. By segmenting your audience and delivering tailored messages, you can nurture leads effectively and drive them toward their mortgage goals. Regular newsletters, informative content, and timely follow-ups can keep your audience engaged and increase your chances of conversion.

Leveraging Pay-Per-Click Advertising

One of the most effective methods for generating mortgage leads is through Pay-Per-Click (PPC) advertising. This strategy allows you to target potential customers actively searching for mortgage solutions, ensuring you reach an audience that’s further along in the buying process.

To make the most of your PPC campaigns, focus on keyword optimization, compelling ad copy, and strategic landing pages. The right keywords can attract high-intent users, while engaging ads can enhance click-through rates. Remember to monitor your budget carefully, as costs can escalate rapidly if you’re not cautious. Also, regularly evaluate your PPC metrics to identify what’s working and where improvements are necessary. By actively managing your campaigns, you can generate quality leads while maximizing your return on investment.

Tracking and Analyzing Performance

After implementing your digital marketing strategies, it’s crucial to track and analyze performance to understand what’s working and what needs adjustment. By regularly reviewing your campaigns, you can make informed decisions that enhance your efforts in generating mortgage leads in Orlando. Utilize available data to refine your tactics and maximize ROI.

Key Metrics to Monitor

The key metrics to monitor include conversion rates, click-through rates, and cost per lead. These indicators will provide valuable insights into your marketing effectiveness and help you understand your audience’s behavior. By analyzing these metrics, you can identify areas for improvement and drive more targeted efforts.

Tools for Analyzing Your Digital Marketing Success

Even the best strategies require good tools to analyze their success. Platforms like Google Analytics, SEMrush, and HubSpot provide comprehensive insights into your digital marketing performance, allowing you to monitor your website traffic, user engagement, and lead generation efforts.

Another powerful resource is Google Analytics, which not only tracks your website’s traffic but also provides detailed reports on user behavior and conversion paths. This can help you identify which marketing channels are most effective, enabling you to allocate your resources more efficiently. SEMrush offers competitive analysis to see how your peers are faring, while HubSpot provides advanced customer relationship management tools. By leveraging these vital tools, you can optimize your marketing strategies and achieve better lead generation results.

Common Factors for Success

Once again, to achieve success in maximizing your mortgage leads in Orlando, consider focusing on several key elements. These include:

- Building a strong online presence

- Utilizing targeted advertising

- Optimizing your website for search engines

- Engaging with your audience on social media

The right combination of these factors can significantly boost your chances of generating high-quality mortgage leads.

Consistency in Marketing Efforts

An vital aspect of digital marketing is maintaining consistency in your marketing efforts. Regularly posting content, engaging with your audience, and updating your online platforms create a reliable presence that potential leads can trust. This not only enhances visibility but also builds a strong relationship with your target market, ultimately leading to more successful conversions.

Staying Updated with Industry Trends

Clearly, staying updated with industry trends is crucial for ensuring your digital marketing strategies remain effective. The mortgage industry is constantly evolving, and being aware of new regulations, market conditions, and consumer preferences will help you tailor your approach. Understanding the latest trends can lead to more informed decisions and relevant marketing campaigns, positioning you ahead of your competitors.

Understanding the latest trends in the mortgage industry not only helps you adapt your strategies, but also allows you to identify opportunities that may arise from shifts in consumer behavior. By keeping an eye on key factors such as interest rate changes, technological advancements, and customer preferences, you can pivot your marketing strategies accordingly. This proactive approach will ensure that you remain competitive and continue to attract quality leads, while also mitigating the risks that come with not staying informed.

Summing up

Now that you understand the simple how-to steps for leveraging digital marketing to maximize mortgage leads in Orlando, you can implement these strategies to enhance your outreach and engagement. By utilizing SEO, targeted ads, and social media, you will attract more qualified leads, build a strong online presence, and ultimately drive conversions. Note, consistency is key, so continually assess and refine your approach to stay ahead in the competitive mortgage market. Your proactive efforts will significantly elevate your success in reaching potential clients.

FAQ

Q: What are the most effective digital marketing strategies for generating mortgage leads in Orlando?

A: To effectively generate mortgage leads in Orlando, consider utilizing a combination of SEO, pay-per-click advertising, social media marketing, and content marketing. Start by optimizing your website with relevant keywords related to mortgage loans specific to the Orlando area. Implement PPC campaigns on platforms like Google Ads targeting local keywords to attract immediate traffic. Leverage social media platforms such as Facebook and Instagram to share engaging content, showcase success stories, and run targeted advertisements. Additionally, publish informative blog posts, videos, and infographics that educate potential customers about mortgage options and the home-buying process in Orlando, establishing your expertise and attracting leads.

Q: How can I measure the success of my digital marketing efforts in generating mortgage leads?

A: Measuring the success of your digital marketing efforts requires tracking several key performance indicators (KPIs). Utilize tools like Google Analytics to monitor website traffic, conversion rates, and user behavior. Key metrics to observe include the number of leads generated through forms or calls, the cost per lead from your advertising efforts, and the engagement rates of your social media posts. Additionally, setting up tracking on your PPC campaigns will allow you to measure click-through rates and return on investment (ROI). Regularly review and analyze this data to refine your strategies and improve your lead generation efforts in the competitive Orlando market.

Q: What role does content marketing play in attracting mortgage leads in Orlando?

A: Content marketing plays a crucial role in attracting mortgage leads in Orlando by providing valuable information that addresses the needs and concerns of potential homebuyers. By creating targeted content, such as blog posts, eBooks, and webinars that focus on the local real estate market, mortgage trends, and home financing tips, you can establish your authority in the mortgage industry. This approach not only builds trust with potential clients but also drives organic traffic to your website through SEO optimization. Additionally, sharing this content through social media and email newsletters helps reach a wider audience, enhancing brand visibility and providing multiple touchpoints to capture leads effectively.