You can successfully increase your mortgage leads in Orlando by implementing a strategic digital marketing plan. Understanding your target audience and utilizing effective online channels will enable you to showcase your services and build lasting relationships with potential clients. In this guide, you’ll learn important tactics to enhance your online presence, leverage social media, and optimize your website for maximum visibility. By taking proactive steps, you can position yourself as a trusted expert in the mortgage industry and harness the power of digital marketing to thrive in a competitive market.

Key Takeaways:

- Targeted Advertising: Utilize digital marketing strategies such as pay-per-click campaigns and social media ads to specifically reach potential homebuyers in the Orlando area.

- Content Marketing: Create valuable and informative content that addresses common mortgage-related questions and concerns, positioning yourself as a trusted resource.

- SEO Optimization: Implement search engine optimization techniques to improve your website’s visibility on search engines, ensuring that your services are easily found by local clients seeking mortgage options.

Understanding the Mortgage Market in Orlando

Before venturing into strategies to attract more mortgage leads, it is crucial to understand the unique dynamics of the Orlando mortgage market. With its vibrant economy, growing population, and constant influx of new residents and investors, the region presents various opportunities and challenges for mortgage professionals. By familiarizing yourself with the local landscape, you can tailor your digital marketing efforts to effectively target and engage your ideal clients.

Key Characteristics of Orlando’s Mortgage Landscape

Little do many realize, Orlando’s mortgage market is shaped by several key characteristics, including a diverse demographic, a flourishing tourism industry, and a competitive real estate environment. These factors drive the demand for homeownership and refinancing options, making it crucial for you to keep your finger on the pulse of local market conditions and customer preferences.

Current Trends Influencing Mortgage Leads

You should be aware that the mortgage industry in Orlando is influenced by several trends, such as increasing interest rates, a competitive housing market, and the shift towards more digital experiences. Understanding these trends not only helps you predict future changes but also allows you to adapt your strategies to capture more leads effectively.

The current landscape is heavily impacted by rising interest rates, which can deter potential buyers while creating urgency for existing homeowners to refinance. Additionally, the competitive housing market means that buyers must act quickly, so maintaining a robust online presence through targeted advertising and informative content is crucial. Lastly, the ongoing shift towards digital experiences means that consumers now expect seamless online interactions for applications and approvals. Your ability to adapt to these trends will place you in a stronger position to generate mortgage leads in Orlando.

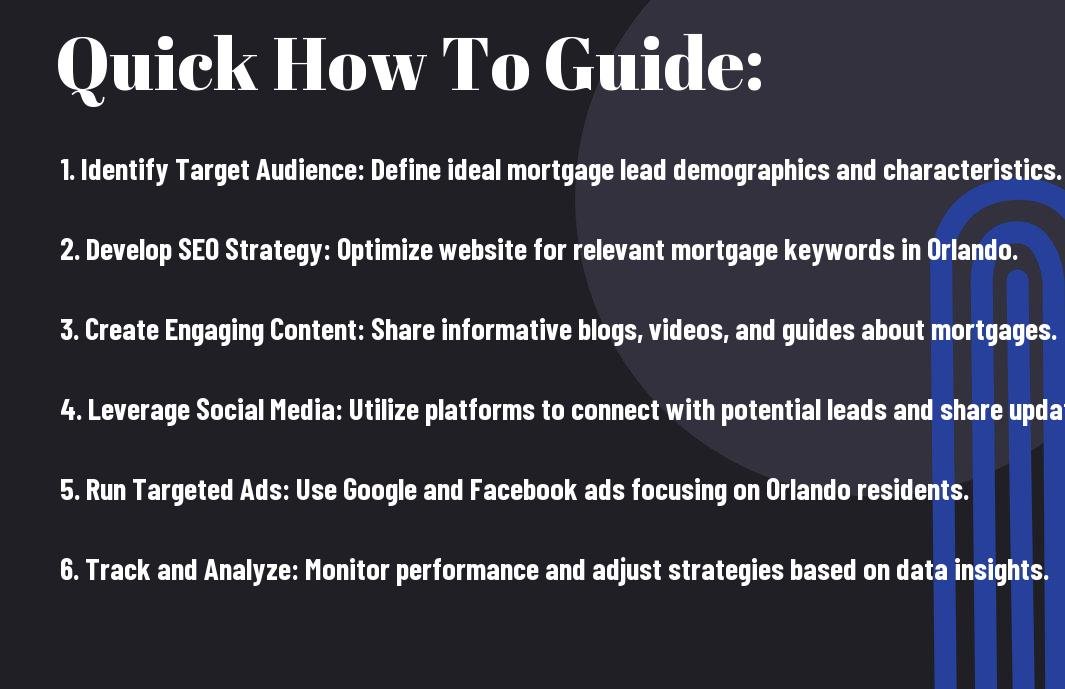

How-To Identify Your Target Audience

One of the key elements in attracting more mortgage leads in Orlando is identifying your target audience. This involves understanding who your potential clients are, their demographics, preferences, and pain points. By clearly defining your market, you can tailor your digital marketing strategies to meet their unique needs, ensuring you reach the right people with the right message.

Defining Your Ideal Customer Profile

Ideal customer profiles help you focus your marketing efforts effectively. Consider characteristics such as age, income, location, and financial status to create a comprehensive picture of your target clientele. By aligning your services with the specific needs of this group, you can streamline your messaging and connect with clients who are most likely to convert.

Utilizing Data Analytics for Targeting

Little do many realize that leveraging data analytics is a game changer in targeting your audience. By collecting and analyzing data from your past leads and current market trends, you can uncover patterns and insights that inform your marketing strategy. This helps you optimize your outreach and ensure greater engagement with your future targets.

For instance, utilizing data analytics allows you to track key metrics like consumer behavior, purchase patterns, and demographic shifts. By applying these insights, you can refine your campaigns and make informed decisions about where to allocate your marketing resources effectively. If you discover, for example, that younger families are increasingly looking for refinancing options, you can tailor your messaging to appeal explicitly to their needs and enhance your engagement rates, thus maximizing your conversion potential.

Digital Marketing Strategies for Lead Generation

Many mortgage professionals in Orlando are turning to digital marketing as a means to attract quality leads. By incorporating strategic methods such as search engine optimization, pay-per-click advertising, and content marketing, you can expand your reach. Utilizing data analytics tools to monitor your results can further enhance your efforts, allowing for adjustments that maximize lead conversion.

Creating Engaging Content for Your Audience

Creating valuable and relevant content is imperative for capturing your audience’s attention. Tailor your blog posts, videos, or infographics to address the specific needs and questions potential mortgage clients have. By providing solutions and insights, you establish authority and trust, making your services more appealing to prospects in Orlando.

Leveraging Social Media Platforms Effectively

Audience engagement can be greatly enhanced through effective use of social media platforms. By actively posting informative content, responding to comments, and hosting live Q&A sessions, you can cultivate a loyal community eager to learn more about mortgages.

For instance, by utilizing platforms like Facebook and Instagram, you can reach a wider audience and showcase client testimonials or success stories that highlight your expertise. Sharing valuable tips and local market updates can position you as a go-to resource. Remember to encourage sharing to amplify your message, as organic reach can lead to more potential clients discovering your services without the need for costly advertising.

Essential Tips for Local SEO Optimization

To attract more mortgage leads in Orlando, you need to focus on Local SEO Optimization. Here are some vital tips:

- Optimize your website for mobile users.

- Use location-based keywords throughout your content.

- Create location-specific landing pages.

- Encourage customer reviews and testimonials.

- Ensure your NAP (Name, Address, Phone) is consistent across all platforms.

Knowing these strategies can significantly enhance your visibility in local search results and attract potential clients.

Importance of Google My Business

Importance of Google My Business cannot be overstated for your mortgage business. By claiming and optimizing your GMB listing, you can boost your credibility and ensure your business appears prominently in local searches. This free tool offers invaluable features for enhancing your online presence, including reviews, location information, and service offerings, making it easier for potential clients to find and choose your services.

Local Keywords and Content Strategies

The secret to driving more leads is using targeted local keywords in your content. You should conduct thorough research to identify high-volume, relevant keywords that potential clients use when searching for mortgage services in your area. This will not only help you in developing high-quality blog posts and landing pages but also improve your search engine rankings.

Local keywords directly impact your visibility on search engines and draw in the right audience. By incorporating location-specific terms into your pages and blog posts, you increase the chances of being discovered by potential clients right in your area. Engage with your audience through valuable, insightful content that educates them on mortgage options and local market trends. Also, consider creating localized content such as success stories from clients in Orlando or guides to obtaining a mortgage in your specific region, as this will not only enrich your website but also foster trust and position you as a local expert in the mortgage industry.

Factors Influencing Your Ad Spend and Budget

Despite the numerous opportunities in digital marketing, various factors can significantly impact your ad spend and budget. Key elements include:

- Target Audience

- Ad Platform

- Geographic Location

- Industry Competition

Recognizing these influences is crucial in formulating a budget that yields effective leads. For more guidance, check out Grow Your Mortgage Loan Officer Business with These Tips.

Understanding Cost-Per-Lead in Digital Marketing

While managing your ad budget, grasping the concept of cost-per-lead (CPL) is vital. This metric reflects the expenses incurred to acquire each potential customer through digital ads, serving as a vital parameter for measuring your marketing effectiveness.

Allocating Resources for Maximum ROI

Understanding how to allocate your resources effectively can maximize your return on investment (ROI). Focus on high-performing ad channels and strategically distribute your budget among various platforms to ensure optimal exposure.

Another vital consideration is to regularly review your ad performance metrics, adjusting your budget allocation accordingly. This proactive approach helps in identifying which ads are yielding positive results and which are draining your budget ineffectively. Allocate funds with caution, minimizing waste and enhancing your reach to potential clients interested in mortgage services.

How-To Nurture Leads Through the Sales Funnel

Keep your leads engaged by providing them with valuable content throughout their journey. Tailor your communications based on where they are in the sales funnel, offering educational resources, personalized updates, and timely follow-ups. By keeping your leads informed and interested, you increase the likelihood of converting them into loyal clients.

Email Marketing Strategies

Marketing your mortgage services effectively requires a solid email marketing strategy. Utilize targeted newsletters and automated follow-up sequences that deliver relevant information based on your leads’ interests and behaviors. Offering exclusive content, such as mortgage tips or market insights, will help establish your authority and keep your brand top-of-mind.

Effective Follow-Up Techniques

Assuming you have already captured leads, following up effectively is key to nurturing them through the funnel. Your follow-up approach should be timely, consistent, and personalized, ensuring that you address the specific needs and concerns of each lead.

HowTo prioritize your follow-up efforts is crucial for success. Use CRM tools to organize and automate reminders, ensuring that no lead is left unattended for too long. Follow up with timing that respects their interests; too frequent can turn your leads away while too infrequent may allow them to forget you. Personalize your messages, referencing their inquiries and showing understanding of their situation. This tailored approach fosters a trusting relationship and vastly improves your chances of conversion.

Summing up

Drawing together the insights shared, implementing a strategic how-to approach for digital marketing can significantly enhance your ability to attract more mortgage leads in Orlando. By leveraging targeted advertising, optimizing your online presence, and engaging with your audience through valuable content, you empower your business to stand out in a competitive market. Consistently analyzing performance and adjusting your tactics will ensure that you stay ahead of the curve, allowing you to cultivate valuable relationships with potential clients and ultimately drive growth for your mortgage services.

FAQ

Q: What are the key components of a digital marketing strategy to attract mortgage leads in Orlando?

A: A successful digital marketing strategy to attract mortgage leads in Orlando should include several key components:

- Search Engine Optimization (SEO): Optimize your website with relevant keywords such as “Orlando mortgage” or “home loan options in Orlando” to improve search engine rankings and make it easier for potential leads to find you.

- Content Marketing: Create informative and engaging content that answers common questions about mortgages, the home-buying process, and the local market. Blog posts, guides, and videos can help establish your authority and attract organic traffic.

- Social Media Advertising: Use targeted advertising on platforms like Facebook and Instagram to reach specific demographics in Orlando. Creating engaging ads that showcase testimonials, special offers, or informative content can help draw in potential leads.

- Email Marketing: Build an email list through lead magnets (like free guides or webinars) and nurture relationships with potential clients by sending regular updates, personalized advice, and valuable mortgage tips.

Q: How can I measure the success of my digital marketing efforts in generating mortgage leads?

A: To measure the success of your digital marketing strategy for generating mortgage leads, consider the following methods:

- Google Analytics: Utilize Google Analytics to track website traffic, page views, and user behavior. Pay attention to metrics like bounce rate and time on site to gauge engagement.

- Lead Tracking: Implement a Customer Relationship Management (CRM) system that allows you to track leads from their initial interaction to conversion. This will help you understand which marketing channels are most effective.

- Conversion Rates: Monitor your conversion rates by analyzing the percentage of visitors who fill out lead forms or request consultations. This can help you identify areas for improvement in your calls to action and user experience.

- ROI Analysis: Calculate the return on investment (ROI) of your digital marketing campaigns by comparing the amount spent on advertising with the revenue generated from closed mortgage deals stemming from those leads.

Q: What digital marketing tactics provide the best return on investment for attracting mortgage leads in Orlando?

A: The tactics that tend to provide the best return on investment for attracting mortgage leads in Orlando include:

- Pay-Per-Click (PPC) Advertising: Invest in PPC campaigns on platforms like Google Ads to target local keywords. These campaigns can drive immediate traffic to your site and generate leads faster than organic methods.

- Local SEO: Optimize for local search by ensuring your Google My Business profile is fully completed and regularly updated. This enhances your visibility in local searches and maps, making it easier for Orlando residents to find you.

- Video Marketing: Create informative videos discussing mortgage tips, the home-buying process, or client testimonials. Video content is highly engaging and can be shared across multiple platforms, increasing reach.

- Webinars and Online Workshops: Host online educational events that cover topics related to mortgages and home buying in Orlando. This helps position you as an expert while directly engaging with potential leads.