Just imagine effortlessly attracting qualified mortgage leads in Orlando with effective digital marketing strategies. In this ultimate guide, you’ll discover proven techniques that empower you to boost your online presence and effectively engage potential clients. You’ll learn how to utilize social media, optimize your website, and incorporate targeted advertising to maximize your reach. By the end of this post, you’ll have a comprehensive blueprint that can help you transform your business and maintain a competitive edge in the mortgage market.

Key Takeaways:

- Digital Marketing Strategies: Implement effective digital marketing strategies tailored for Orlando to effectively reach potential mortgage leads.

- Target Audience Identification: Utilize data analytics to identify and segment your target audience, ensuring your marketing efforts resonate with the right potential clients.

- Engagement and Follow-Up: Establish a robust follow-up process to nurture relationships with leads, using email marketing and social media engagement to maintain interest.

Understanding Mortgage Leads

While the world of mortgage leads may seem complex, grasping the fundamentals can significantly enhance your digital marketing strategy. Understanding what mortgage leads are and the critical importance of targeting the right audience will empower you to optimize your outreach efforts effectively, allowing you to cultivate a robust pipeline of potential clients in Orlando.

What Are Mortgage Leads?

An mortgage lead refers to an individual or entity that has expressed interest in obtaining a mortgage loan. These leads can arise from various sources, such as online inquiries, referrals, or direct marketing efforts. Identifying and nurturing these leads is imperative for mortgage professionals looking to convert interest into actual business.

Importance of Targeting the Right Audience

On targeting the right audience, you can maximize your conversion rates and ensure your marketing resources are utilized efficiently. By focusing on individuals or groups that are more likely to require mortgage services, you can cultivate quality leads that resonate with your offerings.

Another vital aspect of targeting the right audience is the potential to increase your return on investment (ROI). By honing in on demographics such as first-time homebuyers or real estate investors, you not only save on marketing costs but also enhance the likelihood of making successful conversions. Additionally, you can develop personalized messaging that addresses their unique needs and concerns, thereby fostering trust and ultimately leading to higher engagement rates and better customer retention.

How to Identify Your Target Audience in Orlando

There’s no doubt that knowing your target audience is important for successful digital marketing. To effectively reach mortgage leads in Orlando, you need to examine into who they are, what they need, and how you can serve them. Understanding local nuances is critical; for a deep probe social issues, consider reading more about the Utah Mother and Boyfriend Accused of Abuse After Boy…. This could provide insights into demographics you might not have considered.

Analyzing Demographics

For your marketing strategy to be effective, you need to analyze demographics such as age, income level, and family status in Orlando. Recognizing these factors will help you tailor your messaging and offerings, ensuring they resonate with potential clients looking for mortgage services.

Using Market Research Tools

One way to fine-tune your audience targeting is by leveraging market research tools like Google Analytics and social media insights. These tools can provide data on user behavior, preferences, and location, allowing you to structure your campaigns around what appeals directly to your ideal mortgage lead.

Target these resources wisely to gather vital information that highlights local purchasing behaviors and financial needs. Understand how mortgage trends vary across demographics in Orlando, such as first-time homebuyers or retirees looking to downsize. The insights don’t just help you attract leads; they empower you to build trustworthy relationships by delivering content that genuinely addresses the concerns of your audience. Leverage these tools to refine your marketing strategies effectively!

Digital Marketing Strategies to Attract Mortgage Leads

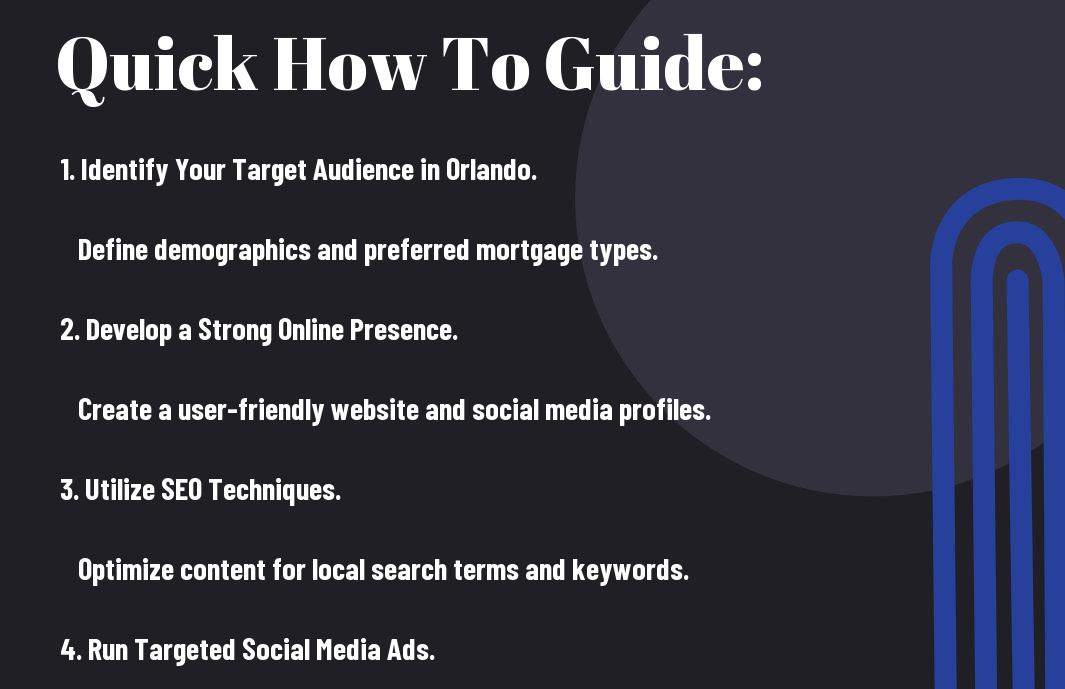

Your success in targeting mortgage leads hinges on effective digital marketing strategies. Employing the right tactics can help you connect with potential clients and grow your business in Orlando. Focus on leveraging SEO, PPC advertising, social media marketing, and content marketing to enhance your visibility and engage your audience.

Search Engine Optimization (SEO) Tips

If you want to improve your online presence, implement strong SEO strategies tailored to the mortgage industry. Start by conducting keyword research to identify relevant terms, such as mortgage rates and home loan pre-approval. Optimize your website content, meta tags, and URLs to enhance search visibility. Additionally, earn backlinks from reputable sources to boost your site’s authority. Knowing these important tips can set the foundation for successful lead generation.

Pay-Per-Click (PPC) Advertising Strategies

You can use PPC advertising to reach potential mortgage leads effectively. By targeting specific keywords related to your services, you can ensure your ads are seen by individuals actively seeking mortgage solutions. Set a budget that works for you and monitor your ad performance to determine which campaigns yield the best results.

It’s vital to create compelling ad copy that highlights your unique selling proposition, as this can significantly improve your click-through rates. Invest in A/B testing to refine your messaging and understand what resonates with your audience. Pay attention to landing page optimization, as a seamless user experience can convert clicks into leads. Bear in mind, strong ROI comes from continual assessment and ad refinement.

Leveraging Social Media for Mortgage Lead Generation

Many mortgage professionals are discovering the immense potential of social media to connect with potential borrowers. By strategically utilizing these platforms, you can build brand awareness, share valuable content, and engage with your audience, all while generating high-quality leads. This approach not only cultivates relationships but also positions you as an industry authority, making your services more appealing to prospective clients.

Choosing the Right Platforms

To effectively target mortgage leads, you must focus on the social media platforms where your potential clients are most active. Conduct thorough research to identify which platforms, such as Facebook, Instagram, or LinkedIn, are best suited for your audience demographics. By prioritizing your efforts on the right channels, you can maximize engagement and enhance lead generation.

Creating Engaging Content

Any successful social media strategy relies on the creation of engaging content that resonates with your target audience. This content should inform, inspire, and address the unique challenges potential borrowers may face when seeking a mortgage.

Plus, incorporating visuals, such as infographics and videos, can significantly increase your post engagement. By sharing educational tips, client testimonials, or industry insights, you can foster trust and establish strong relationships with your audience. Note, the key to successful content is ensuring it is relevant and aligns with the needs and desires of your audience. Consistantly reminding your followers about your expertise and value adds to their journey can lead to a steady flow of leads, converting casual users into potential clients.

Factors to Consider When Nurturing Leads

Now, nurturing your mortgage leads requires a strategic approach to maximize conversions. Key factors to consider include:

- Understanding your audience’s needs

- Crafting tailored messages

- Utilizing the right channels

- Implementing effective follow-up strategies

- Measuring success and tweaking tactics

By focusing on these elements, you enhance your ability to connect with potential clients. Recognizing the nuances of lead nurturing can significantly improve your conversion rates.

Timing and Frequency of Follow-ups

An effective follow-up strategy hinges on the timing and frequency of your communications. You should aim to reach out soon after the initial contact, ensuring your message is fresh in their mind. Consider employing a mix of follow-up methods—emails, calls, or messages—while also maintaining a regular schedule that doesn’t overwhelm prospects. This balance is key to keeping your mortgage leads engaged.

Personalization Techniques

Techniques for personalizing your communications can significantly enhance relationships with mortgage leads. You need to address prospects by their name, reference their specific needs, and tailor your messages based on their behaviors or previous interactions. The more personalized your communications are, the better your chances of establishing trust and rapport. You can use data analytics to segment your audience effectively and send customized content that resonates with them. Do not forget, this builds a stronger connection and increases the likelihood of conversion, making your leads feel valued and understood.

Measuring Success: How to Evaluate Your Marketing Efforts

Despite investing time and resources into digital marketing strategies, it’s crucial to assess their effectiveness continuously. Measuring success doesn’t just signify tracking leads; it involves evaluating the overall impact on your business. Use data-driven insights from various channels to refine your approach, ensuring your marketing efforts align with your goals and deliver a positive return on investment.

Key Performance Indicators (KPIs)

You should establish clear Key Performance Indicators (KPIs) to measure the success of your marketing initiatives. Common KPIs to consider include lead conversion rates, cost per lead, and engagement metrics across various digital platforms. By focusing on these indicators, you gain valuable insights into which strategies are yielding results and which require further optimization.

Adjusting Strategies Based on Performance

Adjusting your marketing strategies based on performance is necessary for staying competitive. Regularly analyze the data you collect to identify trends, areas for improvement, and new opportunities. If certain channels aren’t delivering the results you anticipated, consider reallocating your budget to more effective methods or enhancing your messaging.

Your data analysis should inform important decisions about where to focus your marketing efforts moving forward. If a particular strategy isn’t generating sufficient leads or engagement, it’s vital to pivot and explore alternative approaches. Regularly reviewing your performance will empower you to capitalize on successful tactics while minimizing resources spent on ineffective ones, leading to a more robust marketing strategy in the competitive Orlando market.

Conclusion

With this in mind, leveraging digital marketing strategies in Orlando is necessary for effectively targeting mortgage leads. By implementing the methods outlined in this ultimate how-to blueprint, you can enhance your online presence, attract the right prospects, and ultimately convert leads into satisfied clients. Be mindful of, consistency and adaptability are key; stay attuned to market trends and adjust your strategies accordingly to ensure your success in the competitive mortgage landscape.

FAQ

Q: What are the key digital marketing strategies covered in the Ultimate How-To Blueprint for targeting mortgage leads in Orlando?

A: The Ultimate How-To Blueprint includes a comprehensive range of digital marketing strategies specifically tailored for the mortgage industry. Key strategies include Search Engine Optimization (SEO) to improve your online visibility, pay-per-click (PPC) advertising to target potential leads effectively, content marketing to establish authority and provide valuable information, and social media marketing to engage with your audience. Additionally, the blueprint covers email marketing techniques to nurture leads and convert them into clients, alongside local SEO strategies to optimize your presence in the Orlando area.

Q: How does this blueprint help in identifying and reaching potential mortgage leads in Orlando?

A: This blueprint provides a step-by-step approach to identifying and reaching potential mortgage leads through tailored market research and data analysis. It offers insights into understanding the local Orlando market, including demographics, customer behavior, and competitive analysis. The strategies outlined in the blueprint focus on leveraging digital tools like targeted advertising, local keywords, and personalized communication, enabling mortgage professionals to effectively connect with individuals looking for mortgage services in the area. By optimizing online presence and utilizing strategic outreach, users can drive qualified leads to their business.

Q: Can I implement these strategies if I have a limited budget?

A: Yes, the Ultimate How-To Blueprint is designed to be adaptable for various budget levels. It provides cost-effective strategies that can be implemented with minimal financial investment, such as content marketing through blogs, utilizing social media for organic reach, and local SEO techniques that enhance your visibility without needing extensive ad spends. Additionally, the blueprint includes tips on prioritizing leads and optimizing marketing efforts to ensure that every dollar spent yields a return. This makes it accessible for mortgage professionals with limited marketing budgets to still effectively target and convert leads in the Orlando market.